As debates continue around Nigeria’s new tax laws, the Federal Government has insisted that the reforms are necessary, especially for small businesses and low-income earners.

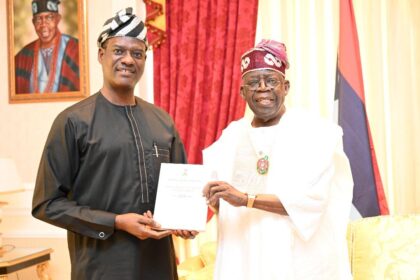

Speaking on the issue, the Special Adviser to President Bola Tinubu on Information and Strategy, Bayo Onanuga, defended the planned implementation of the Tax Act, which is set to take effect on January 1, 2026.

According to Onanuga, delaying the new tax laws would keep many Nigerians trapped in an outdated system that places heavy tax burdens on small businesses, freelancers, and everyday workers. He argued that maintaining the status quo would continue to disadvantage those who already struggle to stay afloat financially.

Onanuga urged critics of the reforms to consider the explanations provided by Taiwo Oyedele, Chairman of the Presidential Fiscal Policy and Tax Reforms Committee, who has repeatedly stated that the new laws are designed to reduce excessive taxation on low-income earners.

The tax reforms have sparked controversy, with concerns raised that the version of the law gazetted by the executive differs from what was passed by the National Assembly. Several stakeholders, including former Vice President Atiku Abubakar and former Labour Party presidential candidate Peter Obi, have called for a pause on implementation until all concerns are fully addressed.

However, Oyedele has warned that postponing the reforms could have serious consequences for small businesses and workers. Speaking on The Morning Brief, he explained that if the tax laws are not implemented by 2026, the bottom 98 percent of Nigerian workers will continue to face multiple taxation.

He added that under the current system, many small and unprofitable businesses are forced to pay unnecessary taxes, while businesses miss out on potential tax exemptions. Oyedele also noted that VAT on food items would remain unchanged, further increasing the cost of basic household goods and putting additional pressure on families.

For entrepreneurs, creatives, and small business owners, the conversation around the new tax laws is no longer just about policy, it is about survival, sustainability, and whether running a business in Nigeria can become fairer in the years ahead.

_thumb.webp)