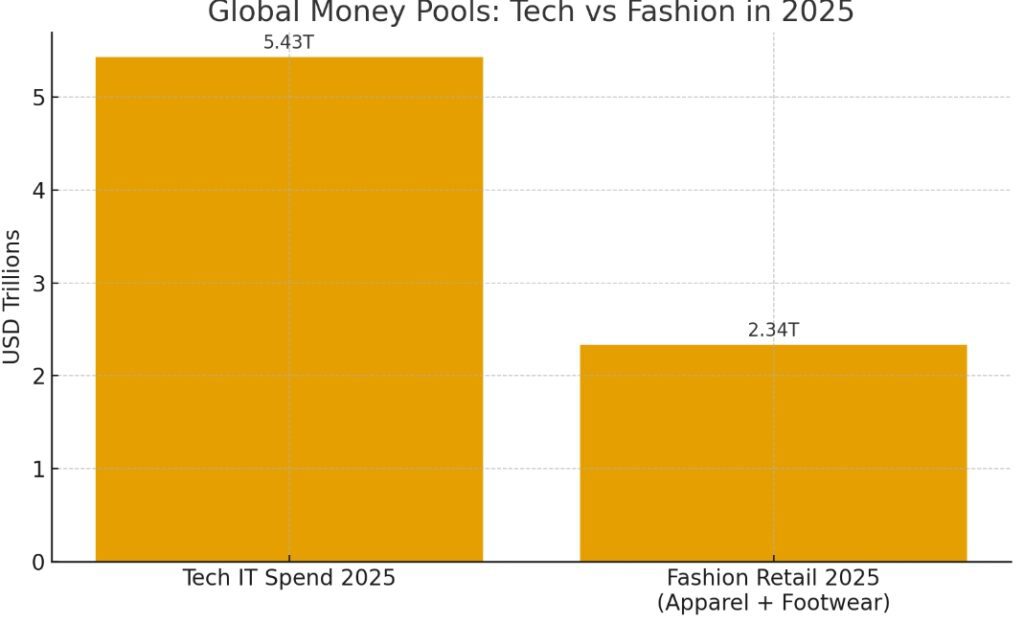

Tech vs Fashion. Both tech and fashion define modern life; one powers how we live, the other shapes how we express ourselves. But when it comes to money, 2025 makes it clearer than ever that technology is far richer than fashion.

- Table of Contents

- The Numbers: Tech vs Fashion, Who Has the Bigger Wallet?

- Titans of Industry: Apple vs LVMH

- Why Tech Is Winning

- a. AI and Automation Are Fueling a Spending Boom

- b. Fashion Growth Has Slowed

- c. Different Business Models

- Fashion’s Edge: Culture and Influence

- How Fashion Can Catch Up

- Glamcityz Take: The Future Is Collaboration

- Conclusion

- Sources

The numbers tell a story of scale. Tech thrives on trillion-dollar budgets and valuations, while fashion, glamorous as it is, remains in the billion-dollar lane. Still, both industries continue to intersect, influencing each other in ways that are changing what “luxury,” “innovation,” and even “style” mean today.

At Glamcityz, we’ve researched how both industries are evolving, studying financial reports, market forecasts, and consumer trends, to understand where the real money flows in 2025. Our research goes beyond numbers; it explores how fashion and technology are shaping each other’s future, from AI-powered design tools to digital couture and the rise of tech-driven luxury experiences.

Table of Contents

The Numbers: Tech vs Fashion, Who Has the Bigger Wallet?

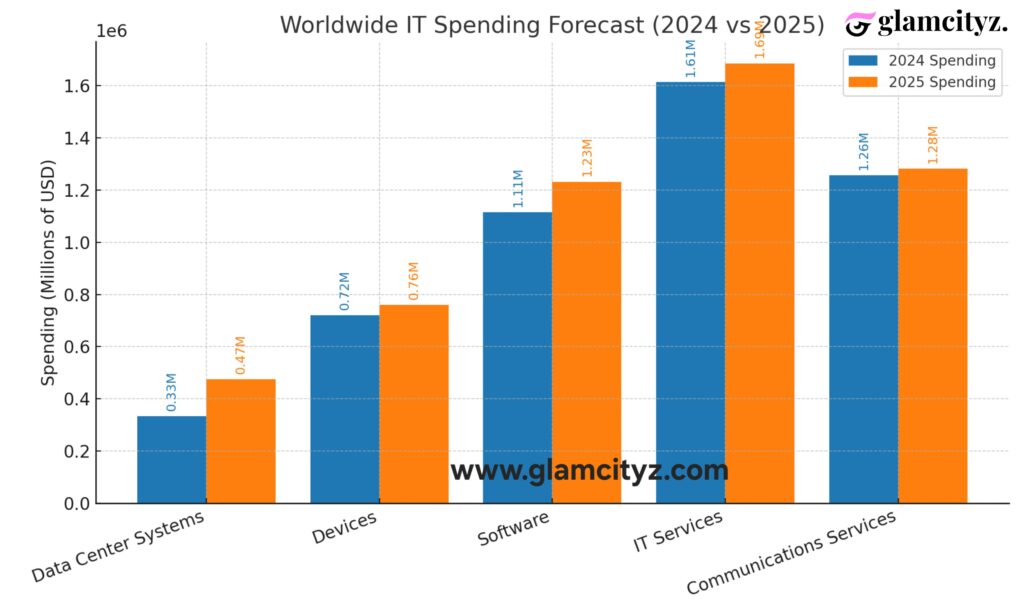

Tech’s Trillion-Dollar Tide

According to Gartner’s July 2025 global IT spending forecast, the world will spend an estimated $5.43 trillion on technology this year, covering everything from cloud services to artificial intelligence (AI), data centers, and consumer electronics. Earlier in the year, the projection was even higher at $5.61 trillion, later adjusted due to market shifts. Either way, the figure sits comfortably above five trillion dollars.

By 2026, Gartner expects the number to cross $6 trillion, driven by AI integration, chip manufacturing, and enterprise cloud expansion. In short, technology is not just growing; it’s consuming.

Fashion’s Billion-Dollar World

Fashion, while massive, plays in a different league. The global apparel industry is valued at around $1.84 trillion in 2025 (UniformMarket), and footwear brings in another $495 billion (Fortune Business Insights).

When you add personal accessories and beauty, total fashion-related consumer spending hovers around $3 trillion, which is impressive, but still about half of what’s being spent on technology.

Even the luxury sector, which commands prestige and exclusivity, is much smaller. Bain & Company’s 2024 report placed the personal luxury goods market at roughly €364 billion, while the broader luxury ecosystem (including hospitality, yachts, jets, and high-end experiences) totals around €1.48 trillion, still dwarfed by tech’s financial gravity.

Titans of Industry: Apple vs LVMH

To put the gap in perspective, let’s compare two of the richest companies in each space: Apple and LVMH.

- Apple (Tech): $391 billion in revenue for fiscal 2024.

- LVMH (Fashion & Luxury): €84.7 billion in 2024 revenue.

That means Apple makes almost five times what LVMH does, even though LVMH owns iconic brands like Louis Vuitton, Dior, Fendi, and Tiffany & Co.

When we consider market valuations, the contrast becomes even sharper:

- Apple, Microsoft, Nvidia, and Alphabet are valued above $3 trillion each in 2025.

- LVMH, the world’s most valuable fashion group, trades around $300–360 billion, just a fraction of a single tech giant’s worth.

In short: tech doesn’t just sell products; it owns ecosystems. Apple’s ecosystem of iPhones, Macs, and services brings recurring revenue that fashion simply can’t match yet.

Why Tech Is Winning

a. AI and Automation Are Fueling a Spending Boom

From enterprise software to personal AI assistants, 2025 marks the peak of global investment in artificial intelligence. Big tech companies like Microsoft, Amazon, and Google are spending billions on data centers, semiconductors, and AI research — all contributing to Gartner’s $5.43 trillion spend.

Meanwhile, companies worldwide are upgrading their systems, investing in cybersecurity, and shifting to cloud-based infrastructure. In other words, tech money flows everywhere.

b. Fashion Growth Has Slowed

After a post-pandemic rebound, the fashion industry entered 2025 on a plateau. Rising production costs, shifting consumer behavior, and economic uncertainty, especially in China, cooled the luxury market.

McKinsey’s State of Fashion 2025 report describes the year as “a cautious one,” with brands focusing more on maintaining relevance than chasing explosive growth.

c. Different Business Models

Tech thrives on scalability and software margins; a new update can reach a billion users overnight. Fashion, on the other hand, still relies heavily on physical production, logistics, and consumer purchasing power. It’s creative and cultural, but less scalable financially.

Fashion’s Edge: Culture and Influence

Despite the revenue gap, fashion’s influence remains unmatched.

From runways to red carpets, what people wear drives identity, conversation, and aspiration. Fashion sells emotion — and that emotional connection keeps it valuable in ways money alone can’t measure.

Even tech companies are borrowing fashion’s cultural playbook. Apple, for example, sells “design,” not just devices. Meta and Samsung have both collaborated with fashion designers to make their gadgets more stylish. The lines are blurring, tech is becoming fashionable, and fashion is becoming tech-enabled.

How Fashion Can Catch Up

a. Adopt Technology at Every Level

AI styling tools, 3D body scanning, and digital try-on experiences are changing how customers shop. Brands that embrace data, automation, and personalization will have the best chance at catching up financially.

b. Focusing on the Creator Economy

Independent designers and influencers can now leverage platforms like TikTok Shop, Instagram, and virtual fashion shows to reach millions, without needing a runway. The more digital fashion becomes, the more scalable it gets.

c. Sustainable Innovation

Consumers are becoming more mindful of waste and sustainability. Investing in eco-friendly materials, digital inventory systems, and resale models can help fashion stay relevant in a tech-driven world.

Glamcityz Take: The Future Is Collaboration

The story isn’t Tech vs Fashion anymore — it’s Tech x Fashion.

The richest future lies at the intersection of creativity and innovation:

- Fashion will use tech to design, distribute, and delight.

- Tech will rely on fashion to remain human, desirable, and aspirational.

As we move toward 2026 and beyond, the industries that win won’t be the richest individually, but the smartest together.

Conclusion

So, which industry is richer in 2025?

Tech — by far. The fashion industry is not even close.

But while tech rules the numbers, fashion still rules the narrative. One defines what’s next, the other defines what’s beautiful about it. And when they collide, as we see in wearable tech, AI-driven styling, and digital couture, the result is the most exciting collaboration of the modern age.

Sources

- Gartner, July 15, 2025 – Global IT Spending Forecast ($5.43T)

- Gartner, January 21, 2025 – Revised IT Spending Report ($5.61T)

- UniformMarket (May 2025) – Global Apparel Market Size ($1.84T)

- Fortune Business Insights (2025) – Footwear Market Forecast ($495.46B)

- Bain & Company (2024) – Luxury Market Report (€1.48T Total, €364B Personal Luxury Goods)

- McKinsey & BoF – The State of Fashion 2025

- Apple Inc. – FY2024 Annual Report ($391B Revenue)

- LVMH Group – 2024 Financial Results (€84.7B Revenue)

- Hermès International – 2024 Annual Revenue (€15.2B)

Transparency Note: The featured chart in this article was enhanced using AI tools to visualize 2025 market comparisons.